Alternatively tax may be assessed at 12 of the rental value. Social Security contribution levels Body Content Employers must pay a 25 rate on their employees earnings between the Standard Earnings Limit 4610 and the Upper Earnings Limit.

Are Nris Eligible For Social Security Benefits

The social tax is payable either by the employer or the employee.

Social security tax ceiling. Nobody pays taxes on more than 85 percent of their Social Security benefits no matter their income. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. Individuals are exempt from real estate tax if the property is not used for business purposes or rented out.

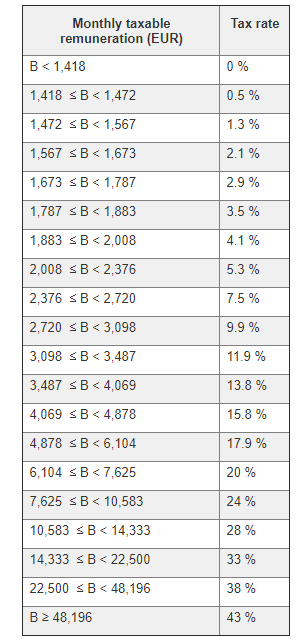

Changes as of 1 January 2020 Monthly social security ceiling From 1 January 2020 the monthly social security ceiling has risen to 3428 which represents an annual ceiling of 41136. The annual tax rate is 12 of the original value of real properties and a tax reduction of 10 to 30 is commonly offered by local governments. The total cost of the Social Security program for the year 2019 was 1059 trillion or about 5 percent of US.

Gift wealth estate andor inheritance tax. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below. Also as of January 2013 individuals with earned income of more than 200000 250000 for married couples filing jointly pay an additional 09 percent in.

Social security contributions are considered to be special expenses dépenses spéciales - DS from a tax point of view. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800. This little nugget of information is potentially useful for pretty much anyone earning a wage but its especially important for those of us that are earning self-employment income.

Social Security Tax Rates. Certain income items which are not subject to social security are subject to a social tax generally 155 percent. Social Security functions much like a flat tax.

The ceilings for the following reference periods are set out below. You would pay taxes on 85 percent of your 18000 in annual benefits or 15300. The social security tax ceiling for 2008 is 102 000.

The US Social Security Administration SSA has announced that the 2021 wage ceiling is increased from USD 137700 to USD 142800 for the Old Age Survivors Disability Insurance OASDI portion of US social security taxes imposed under the Federal Insurance Contribution Act FICA. To save pensions in. In 2021 this limit is 142800 up from the 2020 limit of 137700.

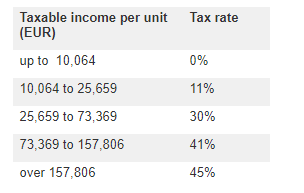

2020 French social security ceilings The annual social security ceiling used to calculate most French social security contributions will increase to EUR 41136 as of 1 January 2020. In 2021 the Social Security tax rate is 62 for the employer and 62 for the employee. Our nearest neighbor Canada has a.

185 percent social security contribution. Say you file individually have 50000 in income and get 1500 a month from Social Security. As a result in 2021 youll pay no more than 885360 142800 x 62 in Social Security taxes.

Medicare taxes are also split between the employer and the employee with a total tax rate of 29. Keep in mind that this income limit applies only to the Social Security or Old-Age Survivors and Disability OASDI tax of 62. Interested readers can find summaries of Social Security provisions at Social Security Programs Throughout the World at the Social Security website.

Taxpayers can deduct their Luxembourg or foreign social security contributions paid to a social security scheme called 1 st pillar scheme from their taxable income. Urban and township land-use tax. The OASDI tax rate for wages paid in 2021 is set by statute at 62 percent for employees and employers each.

The Medicare portion HI is 145 on all earnings. Thus an individual with wages equal to or larger than 142800 would contribute 885360 to the OASDI program in 2021 and his or her employer would contribute the same amount. 2020 tax rates and bands.

The 765 tax rate is the combined rate for Social Security and Medicare. Social Security is funded primarily through payroll taxes called Federal Insurance Contributions Act tax FICA or Self Employed Contributions Act Tax SECA. The spending ceiling of the General State Budgets PGE for 2022 will include a transfer of more than 18000 million to Social Security to guarantee the payment of benefits.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Social Security Trust Fund Will Be Depleted In 17 Years Trust Fund Social Security Benefits Payroll Taxes

Fica Tax Guide 2020 Payroll Tax Rates Definition Smartasset

What Is The Cap For Paying Social Security Taxes For A Joint Return

3 Retirement Tax Mistakes You Can T Afford To Make

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

So Hey Why Not Just Remove The Social Security Earnings Cap

Social Security Tax Cap 2021 Here S How Much You Will Pay

Https Ec Europa Eu Social Blobservlet Docid 13752 Langid En

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Contribution Rates Abbl

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Intro Video Khan Academy

Social Security Tax Cap 2021 Here S How Much You Will Pay

/GettyImages-1168040761-5ae0caa8adf64faa960c2e4964ca1333.jpg)

0 komentar:

Posting Komentar